The Vienna Institute for International Economic Studies (wiiw) have published “Analysis of the Fiscal and Health Impact of Increasing Tobacco Excise Taxes in Ukraine“, which compares the government’s proposal to increase excise taxes on tobacco products, as described in draft law No. 11090, and the alternative proposal in draft law No. 11090-3. This policy outlines the impact of two scenarios of tax reform in Ukraine on budget revenues, prevalence of tobacco use, and mortality prevention using the Tobacco Excise Tax Simulation Model (TETSiM). The study was driven by the current policy discussion of the tobacco taxes for the next three years in Ukraine.

The parliament supported the draft law of the Ukrainian Ministry of Finance’s (MF) in the first reading on June 4. The MF schedule plans a gradual rise in excise taxes to 2028, when a minimum excise tax rate of EUR 90 per 1,000 cigarettes will be reached. However, this draft law treats manufactured cigarettes (MC) and HTPs differently, giving HTPs a tax advantage, with a minimum excise tax rate of EUR 72 per 1,000 HTP sticks. This would create a 20% tax preference for HTPs, which may be beneficial for the interests of tobacco companies sponsoring the war (PMI, JTI).

The alternative draft law No. 11090-3 proposed a more rapid rise in excise taxes. The minimum excise tax rate would reach EUR 120 per 1,000 sticks for both cigarettes and HTPs by 2028. Thus, a uniform tax rate is planned for both cigarettes and HTPs.

On the occasion of the 15th anniversary of Ukraine’s ratification of the WHO Framework Convention on Tobacco Control, Arup Banerji, World Bank Country Director for Eastern Europe, emphasized: “A very important benchmark was, in January 2021, an increase in the excise tax on heated tobacco products (HTP) to equal the minimum excise duty on cigarettes. This is an extremely important measure, and one that we strongly believe should be maintained“.

What did the analysis show?

- The government’s model of excise tax increase will lead to a resumption of the tobacco use epidemic after 2026

The study demonstrates that the model adopted by parliament in the first reading is less effective for both public health and tax revenue purposes.

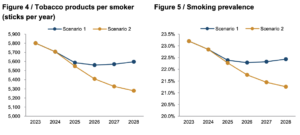

As a result of the adoption of Draft Law №11090 in its current form, tobacco consumption will decrease by only 3.3%, and after 2026 it will start growing again. Thus, efforts to protect public health will be offset.

Screenshot from “Analysis of the Fiscal and Health Impact of Increasing Tobacco Excise Taxes in Ukraine“

The HTP tax advantage could promote substitution, rather than quitting and sometimes even the use of both products. This will lead to an increase in the tobacco epidemic, an increase in diseases and the burden on the healthcare system, and a worsening of the demographic crisis in Ukraine.

If the excise tax is increased uniformly to 120 euros/1000 sticks, the prevalence of the tobacco epidemic will steadily decline, and by 2028 it will be reduced by 8.4%.

- 100 thousand lives at stake: government model is not effective enough to prevent smoking-related deaths

The consequence of the weak impact on reducing the prevalence of tobacco use is the insufficient prevention of premature deaths. According to the World Health Organization, tobacco kills up to half of its users who don’t quit.

The government’s model of raising the tobacco excise tax will save the lives of 65,000 Ukrainians by 2028, while the alternative model (120 euros/1,000 packs by 2028) will avert 165,000 premature deaths.

The government’s model for raising the tobacco excise tax is projected to save 65,000 Ukrainian lives by 2028. In comparison, an alternative model (120 euros per 1,000 packs by 2028) could prevent 165,000 premature deaths.

Screenshot from “Analysis of the Fiscal and Health Impact of Increasing Tobacco Excise Taxes in Ukraine“

Therefore, a more intensive model for increasing tobacco excise taxes would save an additional 100,000 lives.

As a reminder, more than 100,000 Ukrainians die from tobacco-related diseases every year.

- The government’s model of raising the excise tax will result in a shortfall of UAH 66 billion in state budget revenues

According to experts, the model of Draft Law 11090 with a predicted 20% tax preference for HTPs will allow the budget to raise an additional EUR 3.69 billion (UAH 157.8 billion) by 2028, while the alternative model will bring EUR 5.22 billion (UAH 223.7 billion) in additional tax revenues.

Screenshot from “Analysis of the Fiscal and Health Impact of Increasing Tobacco Excise Taxes in Ukraine“

That is, the alternative model is at least 41% more profitable for the state, or EUR 1.53 billion (UAH 65.9 billion). If we take into account the reduction of the burden on the healthcare system and the preservation of the population’s ability to work, this figure increases by a factor of several.

When considering the reduction in healthcare system burdens and the preservation of the population’s workforce productivity, this figure increases even further.

To summarize

A study by the Vienna Institute for International Economic Studies provides convincing evidence that the government’s draft law model is ineffective in the fight against the tobacco epidemic and less beneficial in terms of saving lives and increasing budget revenues compared to the model with a EUR 120 per 1,000 sticks tobacco excise tax.

“A uniform increase in the excise tax on cigarettes, cigarillos, and HTPs to EUR 120 per 1,000 sticks by 2028 is definitely a winning solution for Ukraine: it will reduce the prevalence of tobacco and nicotine use by 8.4% by 2028, save 165,000 Ukrainians from premature death, and generate an additional UAH 224 billion for the state budget”, emphasized Dmytro Kupyra, Executive Director of NGO “Life”.

As a reminder, Ukraine has harmonized the excise tax on cigarettes, cigarillos and HTPs in 2021. This decision was recognized by WHO Director-General Tedros Ghebreyesus as the best international practice. As a result, the State Budget of Ukraine received six times more revenue from excise taxes on HTPs (UAH 10.2 billion in 2021) compared to the previous year (UAH 1.7 billion in 2020).

In the press release dedicated to the tobacco taxes policies in May 2024, Dr. Jarno Habicht, Chief of Mission, World Health Organization Office in Ukraine mentioned that “Heated tobacco products are tobacco products, and all provisions of the WHO Framework Convention on Tobacco Control (FCTC) that apply to traditional tobacco products apply to heated tobacco products, including taxation. Furthermore, the recent WHO report on research and evidence on new and emerging tobacco products prepared for the tenth Conference of the Parties to the FCTC recommends that heating tobacco products be taxed at the same rate as traditional cigarettes. The available evidence is insufficient to substantiate the claims that heating tobacco products reduce the harmful effects of traditional cigarettes“.

The policy of raising excise taxes on tobacco products is supported by the majority of Ukrainians, and its implementation will help overcome the demographic crisis and strengthen the country’s defense capabilities.