On 5 February 2026, in the press hall of the Ukrinform news agency, Advocacy Center “Life” held a press conference dedicated to the outcomes of Ukraine’s excise tax policy on tobacco products. During the event, experts analyzed state budget revenues resulting from increases in tobacco excise taxes in 2025, as well as revenue shortfalls caused by the introduction of a 25% tax preference for heated tobacco products (HTPs) compared to cigarettes. They also assessed the impact of excise tax policy on public health and on preventing premature disease and mortality.

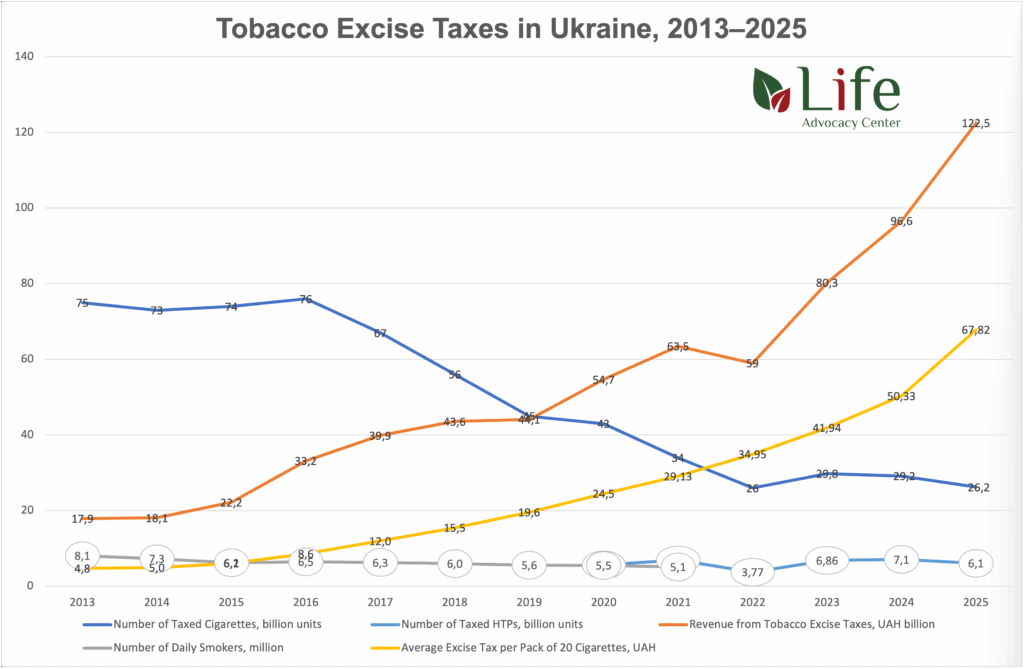

In 2025, revenues from excise taxes on tobacco and nicotine products in Ukraine reached UAH 122.5 billion, which is 27% higher than in 2024 (UAH 96.6 billion), according to the State Treasury Service of Ukraine. At the same time, data from the State Tax Service of Ukraine show that cigarette consumption decreased to 26.2 billion items (–10%), HTP consumption to 6.1 billion items (–15%), cigarillo consumption to 0.6 billion items (–25%), while consumption of nicotine pouches amounted to 144 thousand kg. The reduction in tobacco consumption and the increase in budget revenues became possible due to an effective excise tax policy aligned with Ukraine’s European integration commitments.

“Together with colleagues in Parliament and the Committee on Public Health, we are working to strengthen non-price tobacco control measures in order to effectively protect, first and foremost, children and young people from initiating the use of tobacco and nicotine products. At the same time, a real reduction in tobacco consumption is only possible in combination with a strong excise tax policy, especially with regard to new tobacco and nicotine products, whose popularity among children and youth is growing. These steps are in line with EU and WHO policies,” said Lada Bulakh, Member of Parliament of Ukraine and Member of the Parliamentary Committee on Public Health, Medical Care and Medical Insurance.

Strengthening the excise plan will protect health and fill the budget

In March 2025, Law No. 4115-IX entered into force, introducing a new plan to increase excise tax rates on cigarettes to EUR 90 per 1,000 items and on HTPs to EUR 72 per 1,000 items by 2028 (a 25% preference), as well as a transition to euro-denominated taxation to avoid the impact of hryvnia devaluation. In 2025, the total excise tax on cigarettes increased by 35%, while for HTPs it rose by 22%.

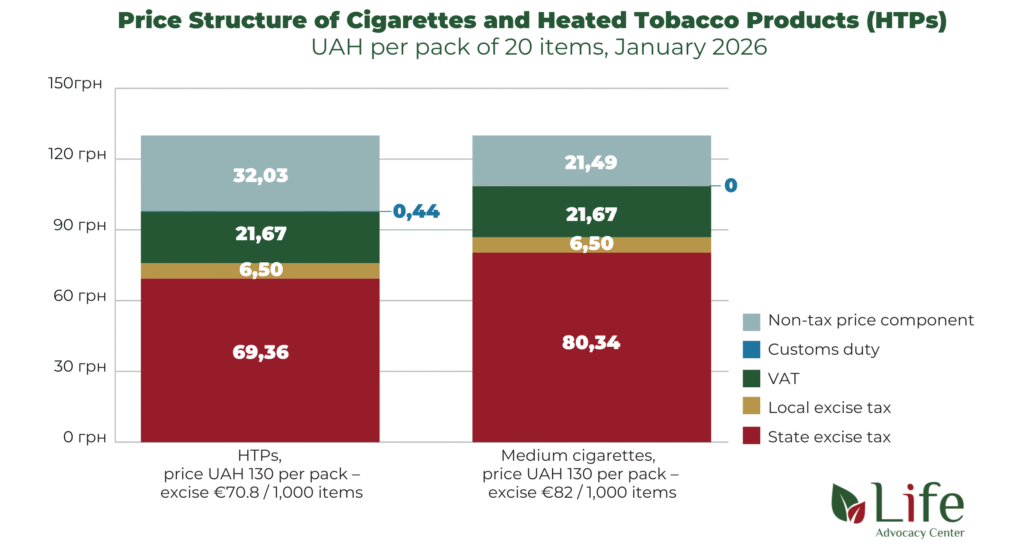

According to this plan, as of 1 January 2026, the excise tax on cigarettes increased to EUR 82 per 1,000 items (+5.13%), while the excise tax on HTPs increased to EUR 70.8 per 1,000 items (+0.6%).

| Product / Year | 2025 | 2026 | 2027 | 2028 |

| Cigarettes, EUR | 78 | 82 (+5,13%) | 86 (+4,88%) | 90 (+4,65%) |

| HTPs, EUR | 70,4 | 70,8 (+0,6%) | 71,14 (+0,5%) | 72 (+1,2%) |

| % by which cigarette excise exceeds HTP excise | 10,8% | 15,8% | 20,1% | 25% |

“Excise taxes on tobacco products are one of the most important sources of funding for victory. They apply only to a specific group of goods that are not essential. In this way, the state reallocates money away from ‘harmful’ consumption without hindering overall economic activity. The state must mobilize this internal resource both by increasing rates and by strengthening efforts to combat illicit trade,” said Illia Neshchodovskyi, Head of the Analytical Department of the ANTS Network.

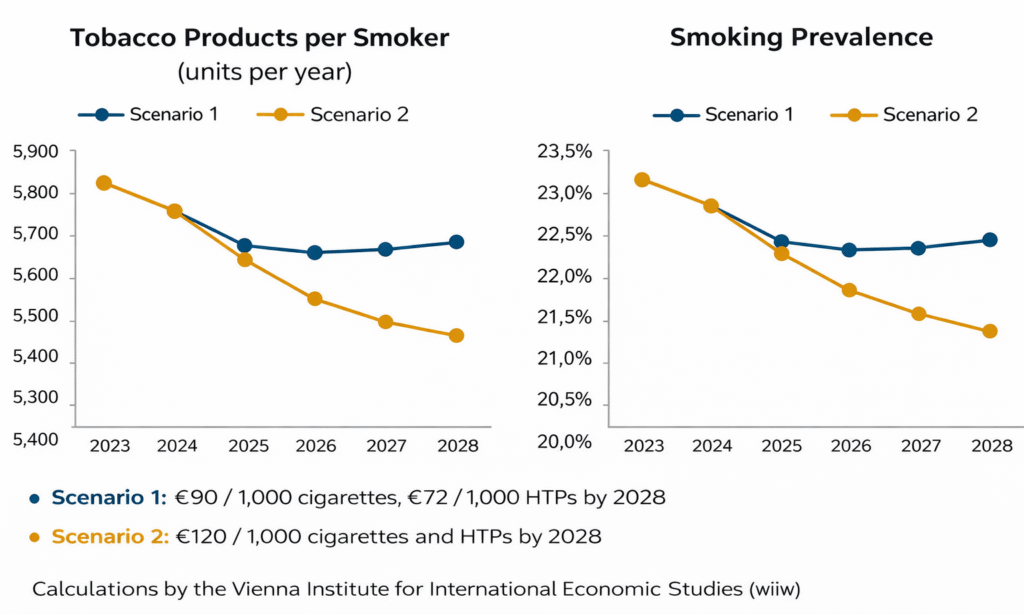

An analysis by the Vienna Institute for International Economic Studies shows that if urgent measures to increase tobacco excise taxes are not taken, the tobacco use epidemic will resume growth as early as 2026.

“Increasing the excise tax on cigarettes by 5% and on HTPs by 0.6% from 1 January 2026 will not have a significant impact on the price per pack and will not contribute to further reductions in tobacco consumption. Ukraine cannot afford a weak excise policy, as this concerns both budget revenues and the survival of the nation, whose population is rapidly declining, including due to diseases caused by tobacco and nicotine use,” emphasized Dmytro Kupyra, Program Director of the Advocacy Center “Life”.

How much Ukraine loses due to excise tax preferences for tobacco companies

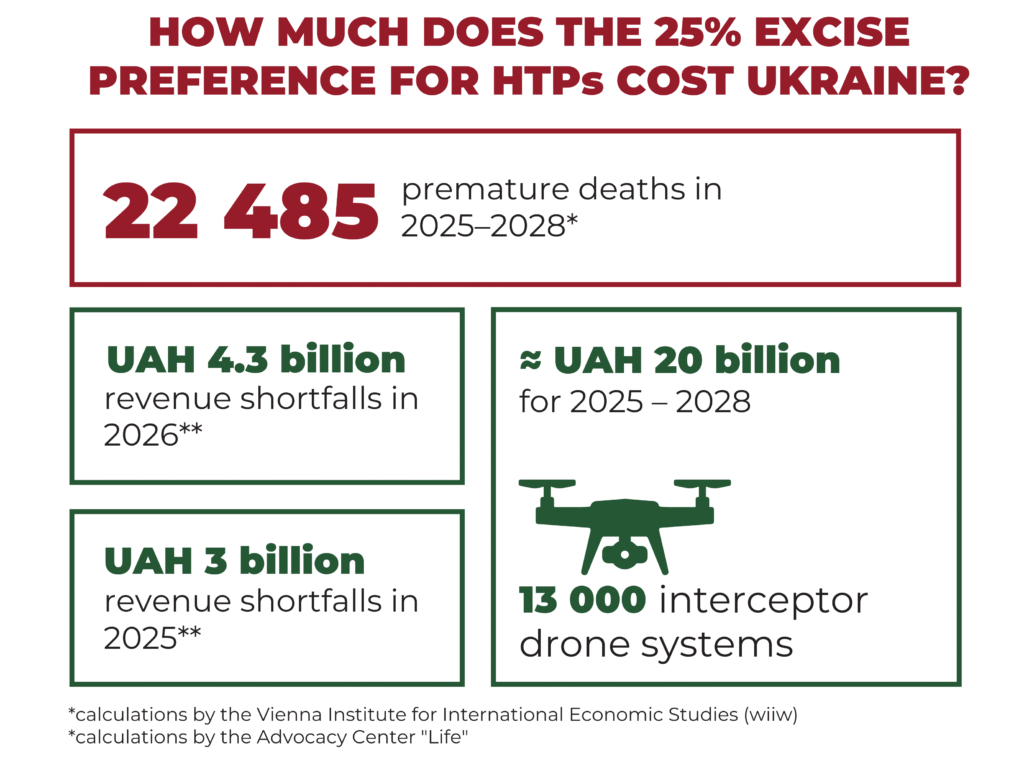

According to estimates by Advocacy Center “Life”, the excise tax preference for HTPs cost Ukraine’s budget approximately UAH 3 billion in 2025. In 2026, revenue shortfalls could amount to around EUR 88 million (UAH 4.3 billion), while total losses for 2025–2028 could reach EUR 422 million, or more than UAH 20 billion.

According to the Vienna Institute for International Economic Studies, the excise tax preference for HTPs will lead to 22,485 premature deaths by 2028.

The World Health Organization calls for taxing HTPs at the same level as cigarettes, as available independent evidence confirms the severe harm to human health caused by the use of heated tobacco products.

Currently, the EU is revising Directive 2011/64/EU on the taxation of tobacco products and is considering increasing the minimum excise rate on cigarettes to EUR 215 per 1,000 items. The new EU Directive will be binding for Ukraine as a candidate country for EU membership.

“WHO supports tobacco taxation as one of the most effective ‘best buys’ for preventing noncommunicable diseases, as it reduces tobacco consumption while generating sustainable public revenue. In Ukraine, consistent excise tax increases since 2019 have contributed to a sharp decline in cigarette consumption, from around 45 billion in 2019 to 26 billion in 2022. Strengthening tobacco taxation in line with new EU regulations is essential for protecting public health, saving lives, and securing vital revenues for Ukraine’s resilience and recovery,” commented Dr. Jarno Habicht, Head of the WHO Country Office in Ukraine.

In 2025, the World Health Organization launched the large-scale “3 by 35” initiative, calling on governments to increase real prices on tobacco, alcohol, and sugary drinks by at least 50% by 2035 through excise tax increases in order to reduce the prevalence of noncommunicable diseases.

“We conducted an analysis of Ukraine’s tobacco excise policy and concluded that increases in excise tax rates did not lead to growth in the illicit market. This refutes claims by the tobacco industry that higher excise taxes fuel illicit trade. Among other recommendations, we propose unifying excise tax rates for cigarettes and HTPs to avoid incentives to switch to lower-taxed products and to strengthen measures to combat illicit tobacco trade,” said Bohdan Slutskiy, economist at the Centre for Economic Strategy.

Given Ukraine’s strategic goal of European integration, the critical need to fill the state budget, and the need to mitigate the demographic crisis, Ukraine’s plan to increase tobacco excise taxes must be reviewed now. This will allow timely adaptation to European standards and strengthen the country’s economic and social resilience.

Contact person:

Olha Masna, Media Coordinator, NGO Life

Phone: +380 73 089 65 70

Email: Olha Masna