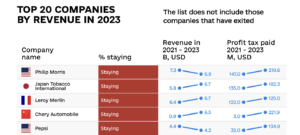

The tobacco companies Philip Morris International and Japan Tobacco International, which are recognized international sponsors of the war against Ukraine, received the largest revenue in Russia among all international companies in 2023 – $13.6 billion ($6.9 billion for PMI and $6.7 billion for JTI), and also significantly increased their profits and, accordingly, profit tax payments – $402 million in 2023 (this is the most recent data on taxes paid by international sponsors of the war to the Russian budget). These are the figures in the latest report (January 2025) of the B4Ukraine coalition based on data collected by the Kyiv School of Economics.

The chart from the B4Ukraine report

By paying $402 million in profit tax alone to the Russian treasury, PMI and JTI tobacco companies could have financed more than 2,429 Shahed UAVs, or 402 Kalibr missiles, or 335 X-101 missiles, which Russia is constantly using to shell Ukrainian territory, destroy infrastructure and ruin lives.

According to the website of the Russian branch of Philip Morris, the company operates 2 factories and a distributor company with branches in 100 cities, as well as about 3,200 employees, whose mobilization is supported by international companies.

Japan Tobacco International has even larger facilities in Russia: 4 factories, 66 offices, 1 distribution company and about 4000 employees.

In addition, PMI and JTI tobacco products are supplied to the occupied Ukrainian territories, most likely from Russia, which once again shows that tobacco companies do not care whether the Ukrainian state will exist, their main concern is making money at the cost of people’s health and lives.

At the same time, tobacco companies are trying to whitewash their reputation by providing humanitarian support to the population of Ukraine, but this is negligible compared to the taxes they pay to Russia. For example, last year, Ukrainian media spread the news that Philip Morris had allocated UAH 400 million for the humanitarian needs of Ukrainians since the beginning of the full-scale invasion, while in 2023 alone, it paid 220 times more in income tax to Russia.

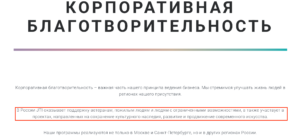

On its Russian-language website, Japan Tobacco International explicitly declares its support for Russian veterans, while the JTI Foundation declares its humanitarian aid to Ukraine.

Screenshot from jti.com/ru/europe/russia

[Translation from russian: In Russia, JTI supports veterans, elderly people, and people with disabilities, as well as participates in projects aimed at preserving cultural heritage, developing, and promoting contemporary art.]

Screenshot from jti.com/sustainability/jti-foundation

Infographic from the B4Ukraine report

How JTI and PMI feel in Ukraine

In 2023, the National Agency for the Prevention of Corruption recognized PMI and JTI as international war sponsors and entered them into the relevant register. In March 2024, the NACP transferred the register of war sponsors to the National Security and Defense Council and now it functions as the State Register of Sanctions. Currently, this register includes only the subsidiaries of the Russian companies Philip Morris Sales and Marketing and J.T.I. Russia, while it is the international corporations that are the owners and ultimate beneficiaries of their subsidiaries. It is they who control the distribution of profits, prices and all key decisions, including tax payments from profits that go to the military budget of the Russian Federation.

PMI and JTI are also members of numerous business associations, which in turn lobby for their commercial interests in the Ukrainian government and parliament. We wrote about this in a separate publication about the double standards of business associations.

The most cynical thing is that international tobacco companies sponsoring the war receive tax preferences for their products from the Ukrainian government.

As a reminder, on December 4, the Verkhovna Rada adopted the government’s draft law No. 11090 on increasing excise taxes on tobacco products, which proposes to increase the excise tax on cigarettes to EUR 90 per 1000 pieces by 2028, and to create a 25% preference for heated tobacco products (“IQOS”). Such a preference will result in a shortfall of at least UAH 18.6 billion in revenues to the state budget over 4 years. The Vienna Institute for International Economic Research has estimated that a lower excise tax on cigarettes will lead to 22,500 premature deaths that could have been prevented if taxation had been uniform. After all, tobacco excise policy is primarily aimed at protecting the population from smoking, which is significantly influenced by the price.

In addition, it is possible to reach the EU minimum level (90 euros per 1000 units) in 2 years, not 4 (as proposed in No. 11090), which will again allow for more significant budgetary revenues from unnecessary harmful products, more than half of which are held by PMI and JTI in Ukraine.

And finally, the entire tobacco industry causes irreparable damage to Ukraine, which is especially noticeable in the context of the demographic crisis: about 100,000 Ukrainians die every year from tobacco-related diseases. To replace dead consumers, tobacco companies are attracting new ones, primarily targeting children and youth. That is why the WHO Framework Convention on Tobacco Control, ratified by Ukraine, obliges states to protect health policies from the influence of commercial and other corporate interests of the tobacco industry when developing and implementing them. Interaction of the government and the public with tobacco companies should be unacceptable, especially with the sponsors of war.