On December 4, 2024, the Verkhovna Rada of Ukraine adopted Draft Law No. 11090 “On Amendments to the Tax Code of Ukraine on Revision of Excise Tax Rates on Tobacco Products”, which implements a plan to increase the excise tax rate on tobacco products by 2028. The draft law is currently awaiting the signature of the President of Ukraine.

What does the draft law provide for?

The key provisions of the draft law provide for:

- converting the calculation of excise taxes on tobacco products into euros to avoid the impact of devaluation;

- reaching the rate of 90 euros per 1000 cigarettes by 2028 (the minimum level of the European Union, obligations under Directive 2011/64/EU);

- creating a 25% discount (72 euros/1000 units by 2028) on excise duty for heated tobacco products (HTPs) (used with devices of the following brands: IQOS, ploom, glo etc.) compared to cigarettes (90 euros/1000 units by 2028);

- increasing the opportunities for forestalling (production of tobacco products and payment of excise duty at rates lower than those that will be in the next period) from 115% to 120%;

- converting the excise tax on e-cigarette liquids into euros at the rate of 300 euros per 1 liter in 2025 (current excise tax is 3000 UAH and 10000 UAH during martial law and/or a state of emergency).

How will excise taxes on tobacco products increase?

In 2025, the excise tax on cigarettes will increase by 35.4% to EUR 78 per 1000 packs, while the excise tax on HTPs will increase to EUR 70.4/1000 packs (by 22%). In 2026, the excise tax on cigarettes will increase by 5%, in 2027 – by 4.8%, in 2028 – by 4.7% and will reach 90 euros/1000 units. The excise tax on HTPs will increase by 0.5% in 2026, 2027, and by 1.2% in 2028, reaching EUR 72/1000 units. Thus, the difference between the excise tax on cigarettes and HTPs in 2028 will be 25%.

| 2024 current (UAH 2516.54) | 2025 | 2026 | 2027 | 2028 | ||

| Cigarettes

Growth, % |

20% | 35,40% | 5,10% | 4,80% | 4,65% | |

| Cigarettes

Excise tax, EUR/1000 pcs. |

57,6 | 78 | 82 | 86 | 90 | |

| HTPs

Growth, % |

20% | 22,22% | 0,56% | 0,48% | 1,20% | |

| HTPs

Excise tax, EUR/1000 pcs. |

57,6 | 70,4 | 70,8 | 71,14 | 72 | |

| Difference in excise taxes, %. | 0% | 11% | 16% | 21% | 25% | |

The excise rate for e-cigarette liquids will increase one-time to EUR 300 per 1 liter in 2025.

How will the price of tobacco products change?

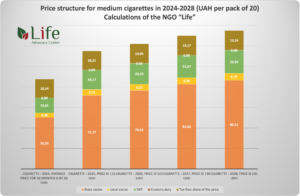

According to the calculations of experts of the NGO “Life”, in 2025 the price of a pack of cigarettes (20 pieces) may increase to UAH 115, in 2026 – to UAH 122, in 2027 – to UAH 130, and to UAH 135 in 2028.

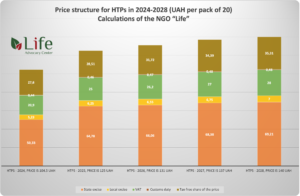

A pack of HTPs may cost UAH 125 in 2025, UAH 131 in 2026, UAH 137 in 2027, and UAH 140 in 2028.

The cost of a pack of both cigarettes and HTPs depends on the manufacturer/importer, which, according to the current Tax Code of Ukraine, independently determines the maximum retail price at which it will sell these products to end consumers.

A weak plan to meet EU requirements

Draft Law No. 11090 was developed and adopted to replace the 8-year excise tax increase plan implemented in 2018. According to this plan, Ukraine was supposed to meet the requirements of Directive 2011/64/EU (EUR 90 per 1000 cigarettes) in 2025. Due to the unaccounted effects of inflation and devaluation on the hryvnia, including those caused by the pandemic and martial law, the law on tobacco excise tax increases had to be updated.

Draft Law No. 11090 extends the reaching of EUR 90/1000 packs until 2028, so the annual growth of the cigarette excise tax will be too weak – 5% annually after 2025. This is not enough to significantly reduce affordability to reduce cigarette consumption. According to the analysis of the Vienna Institute for International Economic Research (WIIW), the model of the excise tax increase of the draft law No. 11090 will lead to a resumption of the tobacco epidemic after 2026.

In addition, the average excise tax on cigarettes in the EU is currently €177 per 1,000 packs, and the European Commission is considering a new excise tax on tobacco products that will be at least €180 per 1,000 packs. In this context, stretching the reach of EUR 90 is a long-sighted decision that may need to be revised in light of Ukraine’s updated commitments to EU integration.

A 25% tax preference for HTPs

Draft law No. 11090 creates a 25% preference (compared to cigarettes) for excise duty on heating tobacco products (HTPs) used with devices such as IQOS, glo, and Ploom. Thus, Ukraine is abandoning an effective practice in favor of tobacco companies, two of which are international sponsors of the war.

In 2021, Ukraine harmonized the excise tax on cigarillos and HTPs to the level of cigarettes. This decision has demonstrated impressive effectiveness: in the first year after implementation, budget revenues from HTPs increased sixfold from UAH 1.7 billion to UAH 10.2 billion, and in 2023 reached UAH 14.4 billion.

Earlier, WHO Director-General Tedros Ghebreyesus congratulated Ukraine on its success in taxing cigarettes and HTPs in a letter to Volodymyr Zelenskyy. The harmonized increase in excise taxes on HTPs and cigarettes was also supported by the World Bank.

As a result of the excise tax preference for HTPs, the budget will lose UAH 3 billion in 2025, UAH 18.6 billion in 2025-2028, and UAH 7 billion for each subsequent year.

WIIW analysts have calculated that a 25% discount on HTPs will lead to the loss of 22,500 lives caused by tobacco use by 2026.

“Despite the position of the World Health Organization, the World Bank, doctors and the public unrelated to the tobacco industry, the decision breaks the best practices of Ukraine in taxing HTPs and in the interests of tobacco companies and creates a discount for “IQOS “. This decision is most threatening for young people, who are the target audience of tobacco industry manufacturers. Among young smokers aged 18-29, 45% use cigarettes for heating (in 2023 it was 37%),” emphasizes Dmytro Kupyra, Executive Director of the NGO ‘Life’.

Interference by the tobacco industry

The draft law No. 11090 was developed by the Ministry of Finance of Ukraine with the participation and approval of the tobacco industry, as emphasized by representatives of the Ministry during the meetings of the working groups on finalizing the draft law. Such cooperation contradicts Article 4 of Law of Ukraine No. 2899 and Article 5.3 of the WHO FCTC.

Letter from the World Bank in support of equal taxation of HTPs and cigarettes

Contact person: Olha Masna, media coordinator of NGO “Life”, 073 089 65 70, olha.masna@center-life.org